By Ronnie Barnes, Kristin M. Feitzinger, Greg Leonard, and Shaama Pandya

This article is the second part of a two-part series. You may read the first part here.

Damages And Causation

In the US, financial economists have assessed damages and causation issues in the context of securities litigation through the use of event studies and other analytical techniques described above. Although uncertainties remain, similar economic considerations and approaches may also be relevant in shareholder actions in the UK.

As the UK litigation landscape continues to unfold, questions regarding damages persist. For example, the initial question of which investors may claim damages under FSMA has not yet been resolved. FSMA Section 90A specifically refers to “any ‘person who has suffered loss’ as a result of the untrue or misleading statement, omission, or delay” and states that “[i]ssuers may be liable to buyers, sellers or holders of securities. . . .”1 Arguably, holders (who, by definition, did not transact in response to any allegedly “untrue or misleading statement, omission, or delay”) would be differently situated than investors who did transact (i.e., purchasers or sellers).

Further, regardless of which investors may claim damages, the methodology (or methodologies) to calculate damages under Sections 90 or 90A of FSMA also remains to be resolved. As the authors of Class Actions in England and Wales note, “FSMA does not specify the basis on which damages arising under [Sections] 90 or 90A will be calculated, and the question has not received any significant judicial treatment to date. This is a complex and difficult area.”2

This section outlines certain economic considerations that may be relevant to assessing damages to purchasers (or sellers) and holders in the UK.

Investors Who Traded: Inflation-Based Damages

A typical claim brought under Section 90A might assert that a company’s public disclosures misstated or omitted (or collectively, misrepresented) certain information during a specified period of time (a “relevant period”). Claimants may assert that the company’s share price was distorted or “inflated” by the alleged misrepresentations, i.e., the share price was higher during the relevant period than it would have been absent the alleged misrepresentations. Claimants would likely also identify one or more “corrective disclosures” that purportedly revealed the previously concealed truth, thereby removing the inflation from the share price by the end of the relevant period.

While the appropriate measure of damages in a particular case is ultimately a legal question, under the theory that the alleged misrepresentations led to an inflated share price, investors who purchased shares during the relevant period would have arguably paid more for the shares than they would have absent the alleged misrepresentations.3

In the Tesco shareholder litigation,4 claimants sought damages that were equal to the highest of four different measures.5 Two of these damages measures compare the price paid for the shares to a subsequent price (the price at which the shares were eventually sold or the price on the date on which the truth was purportedly revealed). These two damages measures fail to account for the fact that the share price over these periods may have changed for reasons unrelated to the allegations. The other two damages measures identified by claimants instead compare the price paid for the shares to an alternative hypothetical price absent the alleged misrepresentations—(1) the “true value [of the shares] at the date of purchase” or (2) “the price that would have been paid [for the shares] if the true facts had been known, or Tesco’s untrue and misleading statements and omissions had not been made.”6

Both of these alternative hypothetical damages measures seem to point to an inflation-based approach similar to the “out of pocket” inflation-based approach (inflation at the time of purchase less inflation at the time of sale) that is used to estimate damages in the context of US securities litigation brought under Section 10(b).7 It is important to note that, if the share price was inflated by the alleged misrepresentations, then any sales during the relevant period would also occur at inflated prices. From an economic perspective, the measure of harm to the investor would need to therefore adjust for (deduct) any “gains” from selling at inflated prices.

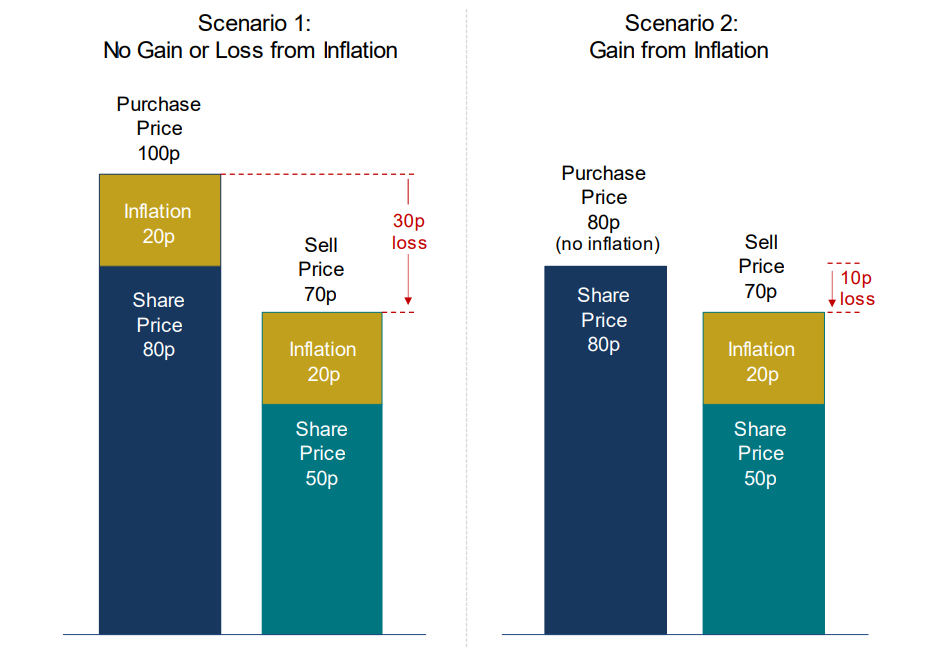

Consider, for example, an investor who purchases a share at a price of 100p at a time when inflation was 20p, i.e., the hypothetical share price absent the alleged misrepresentations was 80p. The investor subsequently sells this share at a price of 70p when inflation is still 20p, i.e., the hypothetical share price absent the alleged misrepresentations was 50p.

Although this investor “paid” inflation of 20p at the time of purchase, all of that inflation was recovered when the share was sold, and, as such, from the perspective of a financial economist, the investor was not harmed by the alleged misrepresentations. In other words, although the investor lost 30p per share on the transaction, the same 30p loss would have occurred even if there had been no alleged misrepresentation. Given that the investor incurred the same “nominal loss” (the difference between the purchase and sales prices) of 30p in the actual world as they would have absent the alleged misrepresentations, the investor’s out of pocket damages are zero.

If the same investor had purchased a share at 80p prior to any alleged misrepresentations (i.e., before there was any inflation in the price), and sold the share at 70p when inflation was 20p, then, from an economic perspective, the investor would have benefited from the inflation. Although the investor suffered a nominal loss on this transaction (selling at 10p lower than the purchase price), the investor nonetheless benefited from the inflation—the hypothetical share price absent the alleged misrepresentations would have been 50p, and the investor’s nominal loss would have been a larger 30p per share.

Inflation

Potential Issues with a Simplistic Approach to Estimating Inflation

In US securities litigation brought under Section 10(b), plaintiffs’ experts frequently attempt to utilise an event study analysis to estimate the inflation removed from the share price at the time of the alleged corrective disclosure(s). They then assert that the share price was inflated by that same amount earlier (and throughout) the relevant period, i.e., they “back-cast” the inflation that they claim was removed from the share price by the alleged corrective disclosure(s) to earlier points in time. However, there are several critical conceptual issues with such an approach that could render the resulting estimate of inflation-based damages unreliable as a measure of harm.

To illustrate some of these issues, consider an extension to the stylised example of ABC discussed earlier:8

At the beginning of 2021, market participants expect the company’s revenues for the coming year to be £10 million. In an efficient market, ABC’s share price reflects, inter alia, market participants’ expectations of £10 million in 2021 revenues.

On April 1, 2021, ABC learns that an important customer has terminated its contract, leading to a reduction in ABC’s revenues for 2021. If the company were to remain silent about the contract termination or reaffirm publicly that 2021 revenues are expected to be £10 million (in line with market expectations), no new information is conveyed to the market that would change market participants’ expectations regarding ABC’s future cash flows.

Then, as previously discussed, on February 1, 2022, ABC announced disappointing 2021 revenues of £9 million, attributing the shortfall to the contract termination and slower sales caused by now-resolved supply chain issues, and ABC experienced a company-specific price decline of 12.4% (or £5).

Typically, a plaintiff’s expert might argue that £5 is the amount of inflation that was removed by the alleged corrective disclosure and that this amount has been in the share price since April 1, 2021, when ABC learnt of (but did not disclose) the contract termination. However, there are several problems with this argument.

First, although the misstatement or omission on April 1, 2021, may have introduced inflation into ABC’s share price, an event study cannot be used to reliably measure its magnitude at that time. To the extent that market participants would have revised downwards their expectations for the company’s future cash flows earlier had the contract termination been disclosed earlier, then a misstatement (reaffirming expected 2021 revenues) or omission (remaining silent) regarding the contract termination artificially maintains ABC’s share price at a higher level than it otherwise would have been. Accordingly, although there is no price response observed at the time of the alleged misstatement or omission (no observable “front-end” price impact), the company’s share price is nonetheless inflated. However, given that there is no observable price movement on the date of the alleged misstatement or omission, an event study analysis cannot be used to measure that inflation.

Second, even in this stylised example, event study analysis alone cannot isolate the inflation removed from the share price at the time the truth was revealed (i.e., on the “back end”). When ABC eventually disclosed lower 2021 revenues (attributable in part to the termination of the customer contract), the price decline that followed reflected the release of other information as well (e.g., the supply chain issues and the plant fire). In other words, although the corrective disclosure removed inflation from the share price, the event study analysis alone can only measure the price decline associated with the total mix of information disclosed, which does not provide a reliable measure of the inflation that was removed from the share price.

Third, even if it were feasible to reliably isolate the inflation removed from the share price following the corrective disclosure (i.e., the portion of the price decline due only to the termination of the customer contract), it is not reasonable to simply assume that the inflation would remain the same throughout the relevant period. For example, if the anticipated revenues from the customer that ultimately terminated the contract changed over time, then the amount of inflation from failing to disclose the contract termination would also vary accordingly.

While a back-casting approach asserting that inflation throughout the relevant period is £5 may be relatively easy to understand and compute mechanically, in order for the approach to provide a reliable estimate of inflation throughout the relevant period, one must establish that a number of underlying assumptions hold. For example, the corrective information disclosed is assumed to be the same as (or economically equivalent to) what allegedly could and should have been disclosed on the first day of the relevant period and everyday thereafter, i.e., the nature and severity of the misrepresentations do not change over time. In the hypothetical example, back-casting requires that ABC knew and was able to disclose the amount of revenues lost due to the contract termination as early as April 1, 2021. Further, under the back-casting approach, it must be assumed that the corrective information disclosed would have had the same effect on the share price had it been disclosed earlier. In other words, back-casting assumes that the price effect of the information is the same over time, regardless of any changes to the total mix of information in the market. Again, market and industry conditions as well as the total mix of information about ABC could change substantially over time.

More generally, if any of the assumptions implicit in the back-casting approach does not hold, then the back-casting approach does not provide a reliable estimate of inflation during the relevant period.

In summary, while the issue of quantum of damages in shareholder actions is ultimately a legal one, and while plaintiffs in Section 10(b) securities litigation in the US often use back-casting to estimate out of pocket inflation-based damages, it is important to consider and address the potential challenges to reliably measuring the quantum of damages under such an approach.

Investors Who Did Not Sell: Holder Claims

The inflation-based damages approach discussed earlier focuses on the difference between the actual share price and the “but for” or hypothetical share price had there been no alleged misstatements or omissions. Under the inflation-based approach, investors’ purchases and sales of shares absent the alleged misrepresentations are assumed to be the same as they were in the actual world, albeit at different prices. Consequently, the inflation-based approach will assess damages only to shares that were acquired during the relevant period (when the share price was purportedly inflated by the alleged misrepresentations).9 Accordingly, an investor who purchased shares before the beginning of the relevant period (when there was no inflation in the share price) will not incur damages under an inflation-based approach.10

However, Section 90A refers to “any ‘person who has suffered loss’ as a result of the untrue or misleading statement, omission, or delay” and states that “[i]ssuers may be liable to buyers, sellers or holders of securities. . . .”11 Although the statute does not specify as much, if holders are investors who already held shares at the beginning of the relevant period and who would claim they continued to hold the shares because of the alleged misrepresentations,12 from an economic perspective, this raises a number of interesting issues with respect to damages. For example:

- Investors who already held shares at the beginning of the relevant period necessarily acquired these shares at a “fair” price, as the shares were acquired prior to any price distortion from the alleged misrepresentations. And, if the shares were acquired at a “fair” price, holders did not “suffer loss” due to the alleged misrepresentations at the time the shares were acquired.

- Until the alleged misrepresentations were eventually corrected, and the share price declined as a result, could the holders “suffer loss as a result of” the alleged misrepresentations from continuing to hold the shares? If holders did not hold the shares through at least one corrective disclosure, could they “suffer loss” due to the alleged misrepresentations?

- Any claim that investors continued to hold shares because of the alleged misrepresentations implies that holders would instead have sold their shares absent these alleged misrepresentations. This arguably implies that alleged misrepresentations would have had to be corrected (i.e., there would have to be some earlier corrective disclosure) in order for the holders to have sold their shares. However, had there been an earlier corrective disclosure, the share price would arguably have declined in response, in which case the holders arguably would have incurred at least that price decline before choosing to sell their shares. Should any economic analysis of damages therefore exclude that hypothetical price decline?

Setting aside these conceptual considerations, the specific damages approach claimants may assert regarding Section 90A “holder claims” remains to be seen. It also remains to be seen whether and how the proposed approach tethers the quantum of damages to the alleged misrepresentations, which could be important if the company’s share price has declined significantly over the relevant period, particularly for reasons other than the alleged misrepresentations.

Reliance

In addition to the economic issues that arise in shareholder actions regarding causation and damages, financial economics may also be relevant in assessing other aspects of litigation, such as reliance. While the legal landscape is evolving with respect to shareholder actions in the UK and Europe and it remains to be seen how courts will address issues of reliance, the economic concepts discussed earlier in this article can also provide insights on the subject.

Section 90A of FSMA expressly requires “reliance” on the alleged misrepresentations,13 but it remains to be seen how courts in UK shareholder actions will adjudicate this legal question.14 To the extent that UK courts require claimants to establish reliance, financial economists could play a meaningful role in assessing the issue. Courts in the US have allowed plaintiffs an indirect presumption of reliance based on a “fraud on the market” theory,15 and the same approach has also gained recent traction in Australian courts.16

The fraud on the market theory is predicated on the notion that, in an efficient market, a share price reflects all publicly available information, including the alleged misrepresentations (as long as they were public). Accordingly, if the market is efficient, an investor who purchased shares at the market price is presumed to have relied (indirectly) on the alleged misrepresentations. If claimants are not able to establish market efficiency, they arguably would not be able to invoke this indirect presumption of reliance. It is worth noting that, in the context of Section 10(b) securities litigation in the US, even if the market were deemed efficient, courts have offered defendants an opportunity to rebut the indirect presumption of reliance if they can establish that the alleged misrepresentations did not have an impact on the share price.17

To date, there is no definitive case law in the UK on the issue of reliance or fraud on the market in shareholder actions.18 Commentators have observed that a broader presumption of reliance (beyond expressly having read and relied on the at-issue statements) may be appropriate, but this “remains a highly controversial and untested question.”19 To the extent that an assessment of market efficiency or price impact is warranted in addressing the legal issue of reliance in UK shareholder actions, the analysis will likely involve financial economics techniques and tools discussed earlier in this article.

Conclusion

Economic analysis will be informative in the context of shareholder actions under Sections 90 and 90A of FSMA, to the extent that such actions materialise in the future. While the litigation landscape in the UK is still evolving, experience in securities litigation in the US suggests that various approaches in the field of financial economics (such as event study analysis, fundamental analysis, etc.) may be applied in assessing causation and damages issues in shareholder actions. It is important to recognise the limitations of these approaches to draw reliable inferences and conclusions in shareholder litigation.

This article was originally published in Cornerstone Research on 12 September 2022. It can be accessed here: https://www.cornerstone.com/wp-content/uploads/2022/09/The-Role-of-Economic-Analysis-in-UK-Shareholder-Actions-2022.pdf

References

- Class Actions in England and Wales, p. 405.

- Class Actions in England and Wales, p. 435.

- The discussion in this section focuses on “inflation” and “purchasers,” but the same economic intuition would apply to “sellers” if the share price were “deflated” due to the alleged misrepresentations, i.e., if the share price were artificially lower than it would have been absent the alleged misrepresentations.

- Manning & Napier Fund Inc v Tesco Plc (Claim no 2016-003088).

- See Class Actions in England and Wales, p. 437.

- Class Actions in England and Wales, p. 437

- The out of pocket approach is used to measure damages in US securities litigation under Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5 promulgated thereunder.

- The stylised example reflects a single alleged corrective disclosure. In practice, there may be multiple alleged corrective disclosures at issue, in which case the back-casting approach often proffered by plaintiffs in US securities litigation under Section 10(b) instead calculates inflation on any day in the relevant period as the aggregate amount of inflation that is purportedly removed by all alleged corrective disclosures that occur subsequent to the day in question. The Role of Economic Analysis in UK Shareholder Actions | Page 10 www.cornerstone.com

- The inflation-based approach would assess damages for these shares if they were sold subsequently during the relevant period, but when the amount of inflation in the share price was lower; or if they were retained until after the last corrective disclosure (when there was no inflation left in the share price).

- As noted earlier, if these shares were sold before the end of the relevant period, they would be sold at an inflated price, i.e., the investor would benefit on this transaction from the alleged misrepresentations. To measure loss resulting from alleged misrepresentations from an economic perspective (although what is recoverable is ultimately a legal question), any such inflation-based gains for a particular investor should be netted against inflation-related losses suffered by the same investor on shares purchased during the relevant period.

- Class Actions in England and Wales, p. 405 (emphasis added).

- For example, in the Particulars of Claim in the G4S litigation, the claimants allege that they “suffered loss and damage by acquiring or continuing to hold G4S Shares . . .” (Particulars of Claim, filed 15 June 2020, p. 1).

- “A loss is not regarded as suffered as a result of the statement or omission unless the person suffering it acquired, continued to hold or disposed of the relevant securities—(a) in reliance on the information in question, and (b) at a time when, and in circumstances in which, it was reasonable for him to rely on it.” FSMA Schedule 10A, ¶ 3(4).

- As a 2019 article observed, “[I]mportantly for tracker funds and retail investor claims, it remains to be seen whether [Section] 90A requires an investor actually to have read and relied upon the published information.” Peter de Verneuil Smith QC et al., “Claims under [Section] 90A of FSMA for Dishonest Statements Made to the Market: An Underutilised Remedy?,” Butterworths Journal of International Banking and Financial Law, March 2019, pp. 154–158 at 154, https://www.3vb.com/images/uploads/vcards/Claims_under_s_90A_of_FSMA_for_dishonest_sta.pdf.

- Basic Inc. v. Levinson, 485 US 224 (1988).

- “Court Endorses Market-Based Causation in Myer Class Action,” Stewarts Law, 22 January 2020, https://www.stewartslaw.com/news/courtendorses-market-based-causation-in-myer-class-action/ (“The significance of the court accepting market-based causation is that it was not necessary to show that a company’s misleading disclosures or omissions had induced a shareholder to purchase shares at an inflated price. Rather it was sufficient to show that the misleading disclosures or omissions had caused the market to trade the shares at an inflated price and that a shareholder who had acquired shares would not have done so at that price but for the market’s reaction to the misleading disclosures or omissions.”).

- Halliburton Co. v. Erica P. John Fund Inc., 573 US 258, 134 S. Ct. 2398 (2014)

- In the Tesco litigation, “the claimants initially ran a ‘fraud on the market’ argument, which Hildyard J described as ‘intriguing’, but abandoned it. . . .” “Rise in UK Stock Drop Claims Not Checked by Tesco,” Clifford Chance, October 2019, https://www.cliffordchance.com/content/dam/cliffordchance/briefings/ 2019/10/securities-litigation-client-briefing-on-tesco-strike-out-s90Aand-reliance-(judgment-update)-done.pdf.

- “Although reliance is an express requirement of the statute . . . , a construction requiring investors to have read the financial statements in question would exclude ‘fraud on the market’ type claims. Such a construction would not sit comfortably with the intention behind the Transparency Director to achieve ‘a high level of investor protection.’ Instead, a broader interpretation of reliance may be appropriate where tracker funds and retail investors rely upon the market price as factoring in the as-represented financial position of the issuer, based in part upon published statements of the issuer. Pursuant to such a construction, reliance on the market price would itself constitute reliance (albeit indirectly) upon the published information.” Peter de Verneuil Smith QC et al., “Claims under [Section] 90A of FSMA for Dishonest Statements Made to the Market: An Underutilised Remedy?,” Butterworths Journal of International Banking and Financial Law, March 2019, pp. 154–158 at 154, https://www.3vb.com/images/uploads/vcards/Claims_under_s_90A_of_ FSMA_for_dishonest_sta.pdf.

About the Authors

Ronnie Barnes is a vice president in the London office of Cornerstone Research. He has testified in a number of cases involving corporate valuation, cost of capital, and financial derivatives. In addition to his work as an expert, Dr Barnes has led teams in a range of high-profile matters involving major financial institutions, including a European Union investigation into the market for complex financial instruments, a number of cases involving structured finance products, and US securities class actions. Dr Barnes has a Ph.D. and an M.Sc., both from London Business School, where he served on the faculty for over ten years.

Ronnie Barnes is a vice president in the London office of Cornerstone Research. He has testified in a number of cases involving corporate valuation, cost of capital, and financial derivatives. In addition to his work as an expert, Dr Barnes has led teams in a range of high-profile matters involving major financial institutions, including a European Union investigation into the market for complex financial instruments, a number of cases involving structured finance products, and US securities class actions. Dr Barnes has a Ph.D. and an M.Sc., both from London Business School, where he served on the faculty for over ten years.

Kristin M. Feitzinger is a senior vice president in the Silicon Valley office of Cornerstone Research. She has more than two decades of experience addressing securities, valuation and governance issues arising in class, corporate and regulatory actions, and is a frequent speaker on these topics. Ms Feitzinger particularly focuses on Rule 10b-5 and Section 11 disclosure cases involving equity and debt trades, and has consulted on more than a hundred such cases, including some of the largest class actions in recent history. Her experience spans all stages of the litigation process, including pre-litigation investigations; exposure analysis and settlement estimation; class and expert discovery; and mediation, arbitration, trials and regulatory agency proceedings.

Kristin M. Feitzinger is a senior vice president in the Silicon Valley office of Cornerstone Research. She has more than two decades of experience addressing securities, valuation and governance issues arising in class, corporate and regulatory actions, and is a frequent speaker on these topics. Ms Feitzinger particularly focuses on Rule 10b-5 and Section 11 disclosure cases involving equity and debt trades, and has consulted on more than a hundred such cases, including some of the largest class actions in recent history. Her experience spans all stages of the litigation process, including pre-litigation investigations; exposure analysis and settlement estimation; class and expert discovery; and mediation, arbitration, trials and regulatory agency proceedings.

Greg Leonard is a senior vice president in the London office of Cornerstone Research and heads the firm’s finance practice and its European finance practice. Dr Leonard has nearly two decades of experience consulting for clients in complex litigation and regulatory proceedings. On behalf of clients, he has led regulatory investigations on both sides of the Atlantic, managing teams and simultaneously supporting experts across multiple related matters. Dr Leonard has substantial experience directing analyses of large and complex high-frequency financial data sets, from both private entities and trading exchanges.

Greg Leonard is a senior vice president in the London office of Cornerstone Research and heads the firm’s finance practice and its European finance practice. Dr Leonard has nearly two decades of experience consulting for clients in complex litigation and regulatory proceedings. On behalf of clients, he has led regulatory investigations on both sides of the Atlantic, managing teams and simultaneously supporting experts across multiple related matters. Dr Leonard has substantial experience directing analyses of large and complex high-frequency financial data sets, from both private entities and trading exchanges.

Shaama Pandya is a vice president in the Washington D.C. office of Cornerstone Research. She leads teams in complex litigation and regulatory investigations related to securities, consumer finance, and valuation. In matters involving equity, debt and derivative securities issued by public companies, Ms Pandya has analysed issues of market efficiency and price impact, materiality, loss causation, inflation and damages across a range of industries. Ms Pandya has worked on matters in a variety of venues, including US federal and state courts, the Delaware Court of Chancery, and international jurisdictions, notably in Latin America and Europe.

Shaama Pandya is a vice president in the Washington D.C. office of Cornerstone Research. She leads teams in complex litigation and regulatory investigations related to securities, consumer finance, and valuation. In matters involving equity, debt and derivative securities issued by public companies, Ms Pandya has analysed issues of market efficiency and price impact, materiality, loss causation, inflation and damages across a range of industries. Ms Pandya has worked on matters in a variety of venues, including US federal and state courts, the Delaware Court of Chancery, and international jurisdictions, notably in Latin America and Europe.

The views expressed herein are solely those of the authors, who are responsible for the content, and do not necessarily represent the views of Cornerstone Research.