Leveraging the right technology will make or break your sales performance. In fact, 68% of retailers said adopting new technology positively impacted their business.

Picking the right point-of-sale (POS) system and payment processor is a critical payment-related decision for your retail business. Both technologies make the buying experience easier and more convenient for customers, which boosts sales.

Luckily, this article will explore some important things to consider when picking both a POS system and a payment processor for your business.

4 Things To Consider When Picking a POS System

Modern-day POS systems are mobile networks that help businesses with payment transactions, invoicing, inventory, accounting, reporting, and employee management.

Here are four things to consider when picking a POS system:

Hardware

POS hardware components allow businesses to accept payments from customers, print receipts, and scan barcodes and QR codes.

Some providers sell all-in-one solutions, while others allow you to choose specific hardware components that suit your business needs. These components include receipt printers, cash registers or cash drawers, barcode scanners, customer-facing displays, and touchscreen displays.

It’s also important to consider the usability of your chosen hardware. You don’t want to waste time training staff to use complex hardware.

Software

POS software allows retailers to track and update inventory, track sales, clock employees in and out, run sales reports, and manage customer accounts and loyalty schemes.

Many POS providers have native software that locks you into their tools. So, if you already use specific software or apps, consider exploring a POS system that integrates seamlessly with the third-party vendors you already trust, such as LoyaltyDog, MailChimp, and Workforce.

Customer support

With retail opening hours changing more than ever, it’s good to have access to customer support whenever needed.

Whether you run into software issues or need help setting up some hardware, look for a POS provider that offers 24/7 support via email, live chat, or phone calls.

Automation

The perfect POS system can automate processes and reduce manual inputs, saving employees time and reducing human errors.

For example, a POS solution should be able to use logistics and supply chain data to automatically update inventory and order information.

4 Things To Consider When Picking a Payment Processor

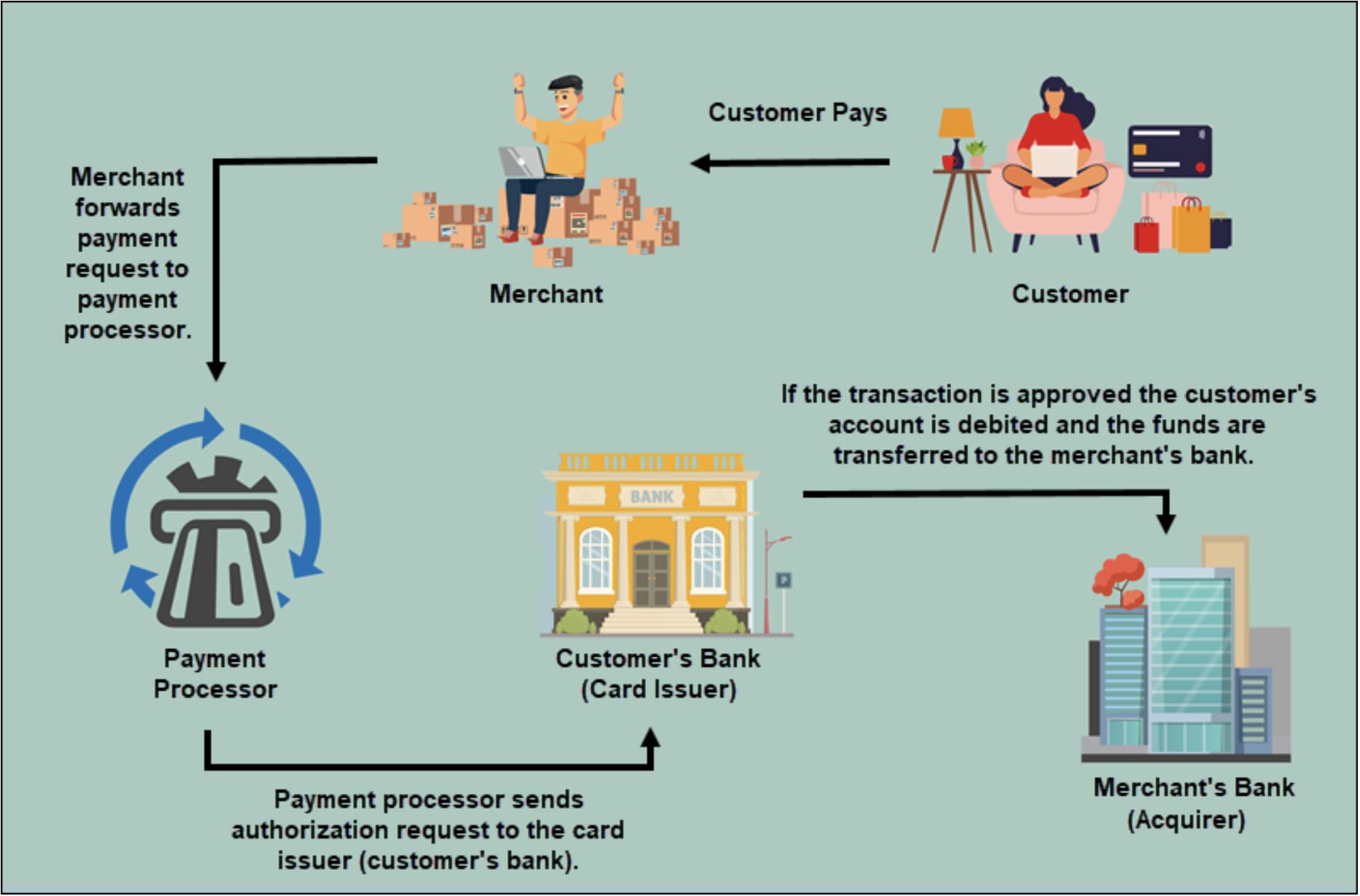

A payment processing company helps businesses accept payments by managing the transaction process between merchants, customers, and financial institutions.

Here are four things to consider when picking a payment processor:

Fees

You must consider the card processing fees related to your chosen payment processor. These fees are a small percentage of the total sale amount – typically ranging from 1% to 5% or more – plus an additional flat fee, which will have been agreed upon.

Compare the additional flat fees of multiple different processors to find the one that best suits your budget.

Remember to opt for a POS provider that allows you to choose your payment processor. Otherwise, you could be left to pay unnecessarily higher fees to whichever processor the POS provider chooses.

Payment methods

Consider what payment methods you’d like to accept at your retail store and ensure that the payment processor you chose supports those methods. This will give customers the opportunity to pay with the method that best suits them.

Debit cards were the most used payment method in 2023, with 23 billion payments, accounting for half of all payments in the UK. However, many customers also use credit cards and mobile wallets like Apple Wallet.

In addition, ensure the payment processor supports the currencies you accept.

Security

Payment security is essential to both the customer and the reputation of your business.

Opt for a payment processor that prioritises security measures such as encryption, fraud detection, and chargeback protection. You’ll also want to ensure that the processor complies with industry data security standards established by the Payment Card Industry (PCI).

Security is especially important for small businesses, which are the victims of nearly 43% of cyberattacks.

Payment speed

Payment speed can impact your cash flow, so consider a payment processor that offers faster processing times.

In addition, you’ll want to consider the payment processor’s hold policy. This is how long the payment processor keeps your funds before depositing them into your business account.

Ready To Pick A POS System and Payment Processor?

As mentioned, picking the right technology is essential for the success of your retail business. However, by considering the things covered in this article, you’ll be well on your way to finding a POS system and payment processor that meets your unique needs.

Remember, the most important considerations may vary depending on your business. While smaller businesses should prioritise security, larger businesses might prioritise software features. Just take your time, do your research, and choose the options that best align with your business goals.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.