Like most other major international financial centres (including Bermuda, the Cayman Islands, Guernsey, Jersey, the Isle of Man and the United Arab Emirates), the BVI has introduced economic substance (ES) requirements for certain entities carrying on specified “relevant activities”.

The Economic Substance (Companies and Limited Partnerships) Act, 2018 was introduced in the BVI, effective 1 January 2019. Related amendments to the Beneficial Ownership Secure Search System Act, 2017 (the BOSS Act) implemented the ES reporting regime.

This article primarily considers the reporting regime. The authors’ general guide to the ES requirements is available here.

Which entities are affected?

All BVI companies and limited partnerships with legal personality must report on their ES position annually (including foreign companies and limited partnerships with legal personality registered in the BVI).

All such entities must identify and report on whether or not they carry on any of nine “relevant activities”. Failure to do so without reasonable cause can result in criminal offences carrying significant penalties (and even personal liability, in limited cases).

What is the timing?

Compliance is measured over “financial periods” (generally of 12 months), with reporting within six months of the end of the relevant financial period.

The first financial periods have already commenced for all relevant entities.

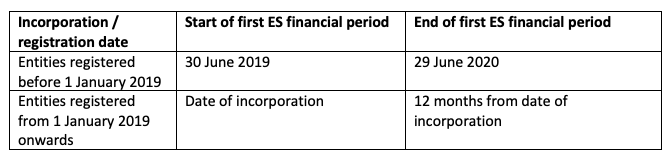

There are default financial periods determined by an entity’s date of incorporation or registration in the BVI as follows:

The ES financial period may well not align with an entity’s financial year for tax, accounting or other purposes (although the two can be altered to match in the future). Unless they have already been altered, the default periods outlined above will apply for the first reporting cycle and then the entity could file an application with the International Tax Authority (ITA) to bring forward the start date of a subsequent period.

The vast majority of active BVI companies were incorporated prior to 2019, so their first reports must be submitted to the ITA by their BVI registered agent (RA) before 30 December 2020. In practice, RAs are setting deadlines to receive the information ahead of the actual deadline, due to the volume of reporting expected. Only RAs can submit information using the BOSS(ES) system – the ITA’s secured confidential database for ES information.

Entities which have not previously considered the ES regime should therefore do so as soon as possible.

Have the deadlines been extended?

The compliance and reporting deadlines were not permitted to be extended by the European Union despite Covid-19. However, the ITA is very aware of the challenges posed by the pandemic. A summary of the ITA’s guidance in this area is available here.

What is the reporting burden on my entity?

In practical terms, the impact depends on the entity’s activities and its tax status. Directors and operators should already be aware of their BVI entity’s obligations and be preparing for reporting, if they have not already reported.

Entities which are part of a group need to ensure that they are considering their individual non-consolidated position and assets and sources of gross income, as intragroup financing or service or other arrangements may be highly relevant to the analysis.

Reporting for entities with no relevant activity or entirely passive entities carrying on “holding business” as a “pure equity holding entity” (as defined) is expected to be straightforward.

However, entities carrying on any other relevant activity – particularly intellectual property (IP) business – or claiming the tax “non-resident” exemption should allow sufficient time to prepare reports, as this can be quite complex and may require input from BVI counsel, accountants and tax advisors.

Entities which carry on any relevant activity also can no longer qualify for exemption under the BOSS Act from reporting on their beneficial ownership as an “exempt person”. This is potentially relevant to listed companies and their subsidiaries, as well as certain other types of entity.

What are the reporting obligations?

Every relevant entity must report at least annually.

Nil returns

Even if no relevant activity was carried on during a financial period, a “nil return” is required.

Relevant activities

If an entity carried on relevant activity during a financial period, it must either (i) submit details to demonstrate how it complied with the ES requirements during the period or (ii) claim and evidence a tax status qualifying it for exemption from the ES requirements as a “non-resident” entity.

Where relevant activity was conducted and the entity is exempt due to its tax status, it will need to submit data which the ITA will use to determine whether it had adequate substance in the BVI throughout the period.

The information required varies according to which relevant activities were conducted, with a simplified compliance and reporting requirement applicable to “pure equity holding entities”.

The table below summarises the reporting requirements for relevant activities other than IP business.

Intellectual property business

There are additional very onerous reporting and evidential requirements for IP business. In practical terms, it may be virtually impossible for some entities to comply with the IP business requirements as they may well be subject to legal presumptions that they are not compliant. There are also increased fines and penalties for certain types of IP business.

Entities with potential IP business should seek legal advice, if they have not already done so.

Tax “non-resident” exemption

In addition to entities which are tax resident outside the BVI, this definition is broader than the name suggests and includes certain entities (other than “pure equity holding entities”) which are tax “transparent” or otherwise subject to tax on their income from relevant activities (for example, due to a taxable branch or permanent establishment), provided that the relevant jurisdiction does not appear on the EU’s list of non-cooperative countries for tax purposes. Evidence complying with the ITA’s guidance will need to be provided in support of the claim.

Such claim will trigger the spontaneous exchange of information by the ITA with the competent authorities in the jurisdiction(s) of tax residence (as well as any EU member state in which a beneficial or legal owner of the entity resides), which may lead to follow-up or investigation to ensure the claim is valid.

Provisional “non-resident” treatment

Generally, evidence of non-resident status needs to cover the entire ES financial period, which may not match the entity’s fiscal period. If more time is needed to supply the evidence required, it is possible to apply for provisional treatment as a “non-resident” in certain circumstances.

Entities considering claiming this exemption or such applications should consider the precise tests and implications with BVI counsel and their tax advisors, if they are at all uncertain.

Can I correct errors in my reports?

If a mistake is made when reporting it should be corrected as soon as possible. The provision of false or misleading information may result in the commission of criminal offences and significant fines and penalties.

If the RA has not submitted the report to the ITA, the RA should be able to assist with correcting the report relatively simply.

If the report has been formally submitted, the RA will need to initiate a correction process with the ITA, which is more complicated and may take time to resolve.

About the Authors

Joshua Mangeot is a member of Harneys’ BVI transactional practice group. He regularly advises leading global law firms, businesses, financial institutions and high-net-worth individuals on BVI law. Josh has a particular interest in complex cross-border transactions and has developed a specialisation advising on the implementation of the BVI economic substance requirements.

Joshua Mangeot is a member of Harneys’ BVI transactional practice group. He regularly advises leading global law firms, businesses, financial institutions and high-net-worth individuals on BVI law. Josh has a particular interest in complex cross-border transactions and has developed a specialisation advising on the implementation of the BVI economic substance requirements.

Amy Roost serves as director of Client Services at Harneys Fiduciary. She provides a wealth of experience in corporate administration and financial services across multiple jurisdictions. Prior to joining Harneys Fiduciary in 2017, Amy headed up the BVI operation of a leading corporate service provider for 13 years.

Amy Roost serves as director of Client Services at Harneys Fiduciary. She provides a wealth of experience in corporate administration and financial services across multiple jurisdictions. Prior to joining Harneys Fiduciary in 2017, Amy headed up the BVI operation of a leading corporate service provider for 13 years.