By Zonghao Bao and Han Wang

This article investigates whether and how the interaction and repeated game between enterprise and stakeholders can influence corporate credibility performance in practice. The authors use the Corporate Social Responsibility (CSR) reports, which are published by 1000 enterprises in Shanghai, as their data source and evaluate their credibility performance in 2015. The findings provide guidelines for social credibility construction in Shanghai.

Evaluation Outcome of Shanghai CSR Reports

The CSR reports, which are used as the data source in our evaluation, are published by 1000 enterprises selected from 16 districts in Shanghai, covering various fields such as manufacture and construction industry, communication and transportation, finance and insurance, and retail business, etc. In our evaluation indicator system, we take Corporate Credibility as one first-order index, and further evaluate enterprises’ credibility performance according to three secondary indexes of Internal Credit Regulations, Credit Behaviours, and Social Image, as well as ten third grade indexes, such as Credit Rating and Credit Disclosing.

The outcome of our evaluation reveals several problems in enterprise credibility performance, and one notable problem is the diffusion of business dishonesty among the enterprises. In our evaluation of Corporate Credibility, more than 100 enterprises are ranked with C or D level. In the evaluation with secondary indexes, 187 enterprises are at C or D level on Internal Credit Regulations, and 303 enterprises are at C or D level on Social Image (see Table 1 below).

Besides, it is worth noting that enterprise internal management of credibility remains at a low level. First, about 30% of the reports fail to provide Corporate Credibility Vision and Credibility Management Plan in the Corporate Outlook section of the report. In other words, credibility management has not yet been incorporated into enterprises’ overarching strategic framework. Second, we find that internal credit institutions, such as supervision regulations, incentive system, punitive measures, and information disclosure mechanism are insufficient in the selected reports. For instance, more than half of the enterprises cannot provide specific clauses and terms on credit management in their CSR reports. Third, in our evaluation 276 enterprises fail to submit Credit Information Reports (2015) provided by credit reporting agency, accounting for 27.6% of the sample enterprises.

Obstacles in Enterprise Credit Behaviours

These problems found in our evaluation spring from some realistic obstacles. Actually, there is a causal relationship between the existing discredit behaviours and the institutional environment in planned economy period in China. To be specific, credibility was for the most part bounded by administrative instructions and planned contracts in the planned economy, thus social operation relied on administrative control and people reduced their demand of credibility in the society. In economic field, corporate credibility had been overlooked for a long time, which led to the deficiency in credit management technology and third-party service, as well as enterprise’s disregard of contract spirit.

The influence of enterprise discredit was unremarkable in the planned economy. However, there has been a serious credit crisis in the period of market transition, and the primary cause lies in the imbalance between enterprise’s insufficient supply and stakeholders’ diversified demands of credibility in their interaction. In fact, trust relationship generated from traditional social mobility and small groups cannot meet the demand of corporate credibility in the market economy. Besides, the institutional environment in the past decades hindered enterprise’s development into mature subject of credit. Driven by its own interests, enterprise tends to ignore stakeholders’ appeals and engage in opportunistic activities. With the expansion of both economic activities and credit scale, enterprise dishonest behaviours give rise to the increase of both credit risk and stakeholders’ losses in the market. Further, despite the fact that stakeholders expect to maximise positive externality of enterprise behaviour, in reality they cannot act in concert to restrict enterprise behaviours, given the path-dependence effect and the tendency of free ride.

Additionally, stakeholder theory has been applied to the CSR studies since the 1990s (Wood, 1991, pp. 696). However, in recent years the domestic research in this field tends to advocate excessively stakeholders’ demands and overlook enterprise’s intrinsic motivation to assume its social responsibilities, which separates enterprise social responsibility from enterprise benefits, and sets enterprise’s gains against stakeholders’ interests. No doubt it goes against enterprise economic target and leads to enterprise’s rejection of social responsibility in practice. Accordingly, enterprise assumes its social responsibility passively without its inherent demands. In the process of economic transition, the profit margins of the Chinese enterprises are squeezed, while enterprises always count their responsibility of credibility as their moral burden.

Three Modes of Repeated Game and Prerequisites for Enterprise

Good Performance of Credibility

In this section, we explore the interrelations of corporate power, corporate responsibility and corporate benefits, and further examine the prerequisites for enterprise’s good performance of credibility through investigating how the interaction and repeated game between enterprise and stakeholders can influence corporate credibility performance in practice.

Corporate power, responsibility and benefits

Based on the theory of modern property-rights economics, corporate power and corporate responsibility complement each other. In terms of corporate power, it refers to some resources which are controlled by enterprises and allow enterprises to influence other groups and individuals on their own behalf. However, with the expansion of corporate power, stakeholders may have their interests infringed upon, which will bring about social problems. Thus enterprises are expected to assume their social responsibility and strike a balance between power and responsibility.

As we have seen, corporate power confirms the necessity of corporate credibility. On the other hand, corporate benefits provide the possibility of corporate credibility in practice. From theoretical point of view, only by gaining more profit, can enterprises carry out responsibilities and make up for stakeholders’ losses. Further, since enterprises are profit-oriented organisations in the market economic activities, their performance of credibility in reality depends on the cost-benefit comparison initiated by credit behaviours. To be specific, enterprises tend to overlook credibility when their benefits cannot make up for their cost. In this regard, enterprises have to make a compromise between their profits and corporate credibility. Thus, it is necessary to establish a dynamic mechanism of corporate credibility which is in accord with economic rationality and enterprise sustainable competitiveness. In this case, corporate credibility will be transformed into moral capital and realise appreciation in the capital cycle.

Three modes of repeated game between enterprise and stakeholders

The discussion so far has focused on the interrelations of corporate power, responsibility and benefits, which provide theoretical basis for our analysis. However, with the diversification of interests in the modern society, enterprise credibility performance in reality depends on the interaction and repeated game among enterprises, consumers, communities, and other stakeholders. In this section, we distinguish three modes of repeated game, thereby exploring the prerequisites for enterprise’s good performance of credibility.

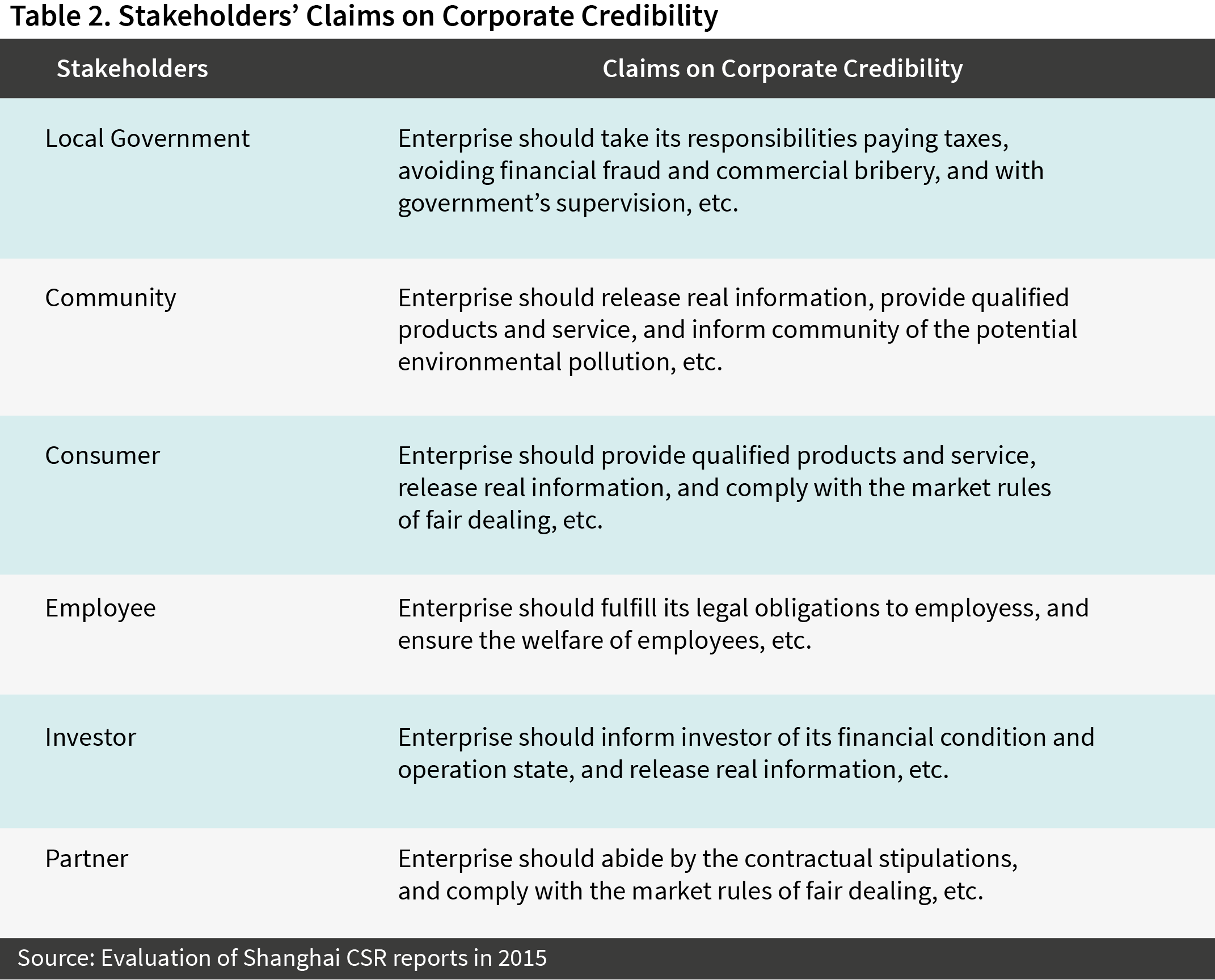

In the market economy, we hypothesise that enterprise and its stakeholders pursue the maximum of their own utility in the absence of central government’s supervision. Since the interest demands and credit risks are diversified, different stakeholders have distinct claims on corporate credibility. According to our data in Shanghai CSR reports, we distinguished six categories of stakeholders: local government, community, consumer, employee, investor and partner (see Table 2 below).

Taken together, local government pursues the maximum of GDP and its tax revenue, thus government’s benefit refers to the increase of GDP and tax revenue. As for other stakeholders, such as communities, consumers and investors, their benefits are manifested as the capital appreciation of various social resources, since enterprise credit behaviours may reduce ethical risks and decrease social transaction cost. Therefore, enterprise’s decision on credibility germinates in its interaction with local government and other stakeholders. The following three modes of game process have different influences on enterprise’s cost-benefit comparison and decision-making process.

Mode 1: We cannot simply measure the benefits derived from enterprise credit behaviours. In this mode, our main hypothesis is that local government does not take any regulatory measures on enterprise behaviours, and stakeholders do not inspect enterprise activities. We assume that most enterprises have good performance of credibility within the moral restraint, and take responsibility for their stakeholders. In this case, local government obtains tax revenue and spends less on regulation, while employees’ claims on enterprise for their interests are admitted. Further, enterprise credit behaviours reduce unnecessary transaction costs between communities, consumers, investors, partners and enterprises, and thus maximise the total social benefits.

Accordingly, enterprise’s cost on social responsibilities will be balanced out by reasonable compensation in the market, since credit behaviours are approved and supported by local government and other stakeholders. Yet it is difficult for us to test whether enterprise benefits derived from credibility are more than the benefits derived from its dishonest behaviours, in the absence of government regulation and economic sanction. Thus we cannot conclude that enterprise credibility accords with its economic targets in reality. However, profit-oriented enterprise tends to ignore its responsibility of credibility under moral restraint, and the hypothesis in this mode is actually impractical.

Mode 2: Enterprise pays more on credibility than the cost on dishonest behaviours. Our assumption in this mode is that local government relaxes control on enterprise dishonest behaviours. Besides, other stakeholders are unable to impose inspection on enterprise activities since their power is loosely consolidated. In this case, enterprise pays more on its credit behaviours than the economic sanction it may receive for its dishonest behaviours. Pursuant to this logic, most enterprises are driven by profits and make a decision to ignore their responsibility of credibility. Thus enterprise makes more profits, while local government obtains more tax revenue and spends less on regulation. However, enterprise dishonest behaviours will undoubtedly damage the interests of communities, consumers, investors, employees and partners, and consequently increase social unnecessary transaction cost. It often causes the imbalance of interests of enterprise, local government and other stakeholders. In this case, local government will continue to relax control on enterprise discredit behaviours, and other stakeholders cannot impose economic sanctions on enterprise with their scanty power. The ignorance of good faith will be gradually diffused in the whole society, which may conversely increase enterprise cost.

Mode 3: Corporate credibility creates more profits than discredit behaviours do. Our assumption is that local government intensifies regulation and applies economic sanction on enterprise, while other stakeholders strengthen supervision on enterprise and promote the approval for enterprise credibility cost. With powerful economic sanction on dishonest behaviours and wide social approval of credibility cost, enterprise cost on credit behaviours is expected to be balanced out by enterprise benefits in the market. In this case, credit behaviours ensure more profits to enterprise, while enterprise tends to make a decision to assume their responsibilities. Besides, local government has stable tax revenue, despite the fact that its regulation cost has risen. Other stakeholders spend more on supervision, yet the appeals for their own interests are effectively responded to. Consequently, enterprise credit behaviours will reduce social unnecessary transaction cost and maximise total social benefits, while a new equilibrium between enterprise and stakeholders will emerge, which ultimately impels enterprise to carry out their responsibilities and continuously improves social awareness of good faith.

Taken together, our assumption in mode 3 suggests that local government should intensify regulation and apply economic sanction on enterprise’s dishonest behaviours, while the whole society should strengthen supervision on enterprise and promote social approval of enterprise credibility cost in the market. In this case, corporate credibility will be transformed into moral capital in the market, and the credit behaviours will meet enterprise economic target in repeated game.

Exploring Implementation Mechanism of Corporate Credibility

We have developed three hypotheses and discussed the relevant modes of repeated game to examine the prerequisites when enterprise assumes its responsibilities well. In fact, mutual benefit derived from the game process between enterprise and stakeholders is the main enabling factor in the implementation of credit behaviours. Thus, we try to explore implementation mechanism of corporate credibility and provide benefit drive for enterprise credit behaviours. In this article, we name it as joint mechanism of corporate credibility (see Figure 1 below), which consists of enterprise self-discipline, government regulation and social supervision.

Intrinsic Dynamic Mechanism

As the figure shows, there are two levels in the joint mechanism: intrinsic dynamic mechanism and extrinsic pressure mechanism. Intrinsic dynamic mechanism is an organic whole which includes three essential aspects. The first aspect refers to enterprise’s awareness of competitiveness. According to social identity theory, an enterprise with good performance on credibility is expected to obtain positive social image and wide acceptance. The trust relationship and mutual benefits help enterprise to receive more policy supports and rewards, long-term clients and investors, as well as professional talents. Furthermore, good performance on credibility provides enterprise the permit into global market and accelerates its success in the global economy. On the contrary, an enterprise without good performance on credibility might be ultimately eliminated from the market, since its negative social image ruins its reputation and competitiveness. Therefore, enterprise is encouraged to bring credit management into line with their strategic management system so as to establish positive social image on the strategic level and improve enterprise competitiveness.

In the second aspect, enterprise is expected to strike a balance of power, responsibility and benefit. On the one hand, enterprise power is a prerequisite for acquiring benefits. On the other hand, enterprise’s exercise of power confirms the necessity of credibility. In fact, this argument is in accord with the iron law of responsibility suggested by Davis and Blomstrom (Davis & Blomstrom, 1966, p. 174). According to Davis and Blomstrom, enterprise’s acquisition and exercise of power must accord with enterprise responsibility. In this sense, in the reform of socialist market economic system in China, enterprises with different nature of property rights, such as state-owned enterprises and private-owned enterprises, are expected to attach importance to their responsibilities and strike a balance between power, responsibility and benefits.

Third, enterprises are encouraged to take actions to intensify internal credit management and to release CSR reports regularly. According to our evaluation, most enterprises have not yet established an effective system of internal credit management. Accordingly, enterprises are expected to operate credit management by project, as well as to integrate credit rating and disclosing into their regular credit management system. Meanwhile, it is important to establish independent department for resolving problems in internal credit management and balancing interests in repeated game. Furthermore, in publishing CSR reports, enterprises are expected to inform stakeholders of their credit information, as well as credit management plan with more accuracy.

Extrinsic Pressure Mechanism

In figure 1, we suggest four points in extrinsic pressure mechanism. First, well-designed policies and institutions of credibility provide pressure mechanism for the interaction, coordination and compromise between enterprises and stakeholders. Since self-discipline mechanism of enterprise may not function independently, external policies and institutions can be used as heteronomous instruments which reduce enterprise opportunistic activities through motivation, restriction, information transmission, and social integration. In countries where credit institutions are well designed, economic sanctions can be applied effectively on discredit. The Social Credit System Construction Plan (2014-2020) was published by the State Council in 2014, but there are some difficulties in its implementation with the lack of operation details. Accordingly, the Chinese government and legislature ought to enrich specific clauses in credit system construction and to urge Chinese enterprises to fulfil their responsibilities. To be specific, credit bylaw should protect the authenticity and validity of the data in credit disclosing. Meanwhile, taxation policy should be well designed in policy-making process in order to influence enterprise’s decision on credibility, as well as to accelerate capital flow and resource allocation. Furthermore, credit rewarding and punishing system should be improved to increase enterprise’s cost on dishonest behaviours and push moral capital into the market. Last but not least, mass media constitute “channels” of communication and a major forum of the public sphere in modern societies (Botelho & Kurtz, 2008, p. 13). As an equally important power with legislative power, judicial power and administrative power in China, media supervision impels enterprise to act in good faith through propaganda and education.

Second, mature social organisations have access to different resources of power and are able to use many strategies to persuade enterprise to act in a particular way in repeated game. Thus, social organisation construction is a key enabling factor of corporate credibility in practice. According to our evaluation, we suggest to build up the industry self-discipline supervision system, as well as to establish the democratic participation mechanism through the construction of labour union and workers congress. These measures will play a major part in market operation of credit reporting and development of credit management network with government regulation, industry self-discipline and social supervision.

The third point refers to the cost burden of corporate credibility which has to be borne by the society. As the scarce resource in the market, credibility creates profits for enterprise. But at the same time, enterprise has to pay a higher price for credibility’s access into markets. Broadly speaking, enterprise’ cost on credibility will be approved and compensated by the market when stakeholders are willing to pay for enterprise credibility and reject enterprise dishonest activities. As such, enterprise benefit derived from credibility will actually exceed the benefit from dishonest activities. In the extrinsic pressure mechanism, consumers are expected to play a role in boosting corporate credibility and to purchase products from the enterprises with good performance of credibility. In addition, social investment in corporate credibility will accelerate capital flow into enterprises with good performance, and thus cull the enterprises with discredit behaviours. In this sense, social approval and social investment will help to impel corporate credibility into the market.

A final point to note is that the evaluation indicator system of corporate credibility and the database of credit information still need to be developed in the extrinsic pressure mechanism. The evaluation indicator system provides action guide for enterprises and evaluation standards for government and social organisations, and helps the Chinese enterprises to perform better in international market in the globalisation tendency. Our evaluation of corporate credibility is conducted on the comparability, innovativeness and substantiality of the CSR reports through measures of qualitative assessment and quantitative statistics, which marks the traits and status of social credibility construction in Shanghai. Further, the evaluation of enterprise credibility relies heavily on data acquisition and data analysis in the age of Big Data, thus an extensive database of enterprise credit information is expected to be developed in the future to provide authentic data for enterprise credit management in China.

To conclude, interactions between enterprise and stakeholders can influence enterprise performance of credibility in practice. Thus the joint mechanism, which consists of enterprise self-discipline, government regulation and social supervision, is expected to provide both intrinsic dynamic and extrinsic pressure for corporate credibility. In effect, it is possible for enterprise to strike a balance between corporate credibility and corporate benefits in repeated game with stakeholders.

About the Authors

Zonghao Bao is the President of Shanghai Academy of HuaXia Social Development Research. He is also a professor and doctoral supervisor in School of Humanities at East China University of Science and Technology. Professor Bao is an expert in Philosophy and Social Science, and he received several awards because of his extraordinary research and contributions to social science.

Zonghao Bao is the President of Shanghai Academy of HuaXia Social Development Research. He is also a professor and doctoral supervisor in School of Humanities at East China University of Science and Technology. Professor Bao is an expert in Philosophy and Social Science, and he received several awards because of his extraordinary research and contributions to social science.

Han Wang is a member of Professor Bao’s research team. She is currently a PhD candidate in School of Humanities at East China University of Science and Technology. She has studied in Australia for two years, and in recent years she has conducted her research on Ethics and Economic Ethics.

Han Wang is a member of Professor Bao’s research team. She is currently a PhD candidate in School of Humanities at East China University of Science and Technology. She has studied in Australia for two years, and in recent years she has conducted her research on Ethics and Economic Ethics.

References

• Botelho, D., & Kurtz, H. (2008). The introduction of genetically modified food in the United States and the United Kingdom: A news analysis. The Social Science Journal, 45, 13-27.

• Davis, K., & Blomstrom, R. L. (1966). Business and its Environment. NewYork: McGraw-Hill.

• Wood, D.J. (1991). Corporate Social Performance Revisited. Academy of Management Review, 16 (4), 691-718.