The article is adapted from the author’s latest book ‘The Business of Healthcare Innovation‘ (Cambridge University Press, 2012)

Innovation and the Value Chain in Healthcare

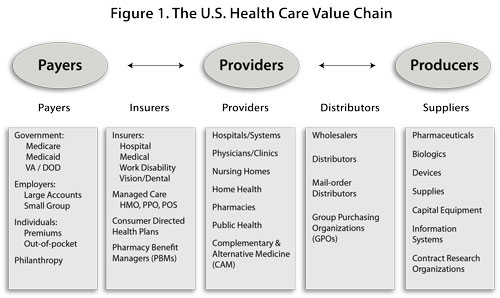

The argument advanced by The Business of Healthcare Innovation (Cambridge University Press, 2012) is simple: company executives who sell healthcare products, providers who utilize those products in patient care, and policy-makers and scholars who study healthcare markets need to understand the value chain in healthcare (see Figure 1). A value chain is defined as the string of firms and industries (sellers) whose outputs serve as the inputs of others downstream (buyers).

The structure of the value chain in healthcare is complex: there are three key sets of actors and two sets of intermediaries between them. The three key sets of actors are the individuals and institutions that purchase healthcare, provide healthcare services, and produce healthcare products (purchasers, providers, and producers). Two sets of intermediaries separate these key actors: those firms who finance healthcare (offer insurance to the purchasers and handle reimbursement to the providers) and those who bulk buy and distribute products (from the producers to the providers).

The logic of this chain is a bit more interesting. The money pumped into the healthcare system starts on the left side of Figure 1 and flows to all of the boxes to the right. Conversely, much of the innovation in healthcare starts on the right side and flows to the adjacent boxes on the left. The two flows collide in the middle: doctors and hospitals who have to determine how much of the innovation from the right side they can afford to utilize in patient treatment given the limited supply of funds received from the left side. This is the point at which much of the spending on healthcare and the consumption of healthcare products takes place.

Earlier research has examined the flow of money, products, and information between producers, providers, and their intermediaries (wholesalers, distributors, group purchasing organizations).1 This book examines five sets of producers of the innovative products in the healthcare industry:

• Pharmaceutical sector

• Biotechnology sector

• Genomics and proteomics sector

• Medical device sector

• Information technology sector

The book examines the competitive dynamics among firms in these sectors and the push for technological innovation that distinguishes them from other sectors of healthcare. The book also highlights the growing convergence among these sectors, as innovations in one sector are utilized by others, and the forces converging to alter the demands on and needs of providers (customers) downstream.

The Technological Imperative in Healthcare

The five industry sectors listed above are responsible for supplying a majority of the innovative products that are utilized by physicians and hospitals and which are increasingly demanded by consumers. This supply and demand logic has exerted both positive and negative effects.

On the one hand, technology is commonly cited as being the major driver of rising healthcare expenditures worldwide. Scholars have characterized this driver as the “technological imperative” – that is, innovative treatments and equipment are demanded by patients and their (physician) agents on the grounds of quality, and are reimbursed by payers and their fiscal intermediaries. Indeed, empirical evidence from the United States documents that the cost of new technology, and the intensity with which it is used, consistently accounts for anywhere from 20 percent to 40 percent of the rise in health expenditures over the past forty years (see Figure 2).2 On the other hand, there is growing public recognition, based on recent scholarly evidence, that new technology contribute to increases in longevity and mobility, reductions in disease and pain, improvements in worker productivity, and improvements in quality of life – – especially for patients with particular conditions.3

The Innovation Challenge

All of the healthcare sectors studied here are considered “high-technology” in which innovation is the key driver of competitive advantage and commercial success. Successful innovation hinges on many factors, including serendipity of discovery, wise paths taken in the past, wise investment decisions in the present, wise options taken out on the future, and access to new technologies via mergers and acquisitions (M&As) and strategic alliances. These factors manifest themselves in terms of favourable market structures, the possession of key resources and capabilities, and fruitful ties with other organizations upstream and downstream in the value chain. However, successful innovation also rests largely on the process skills or the art of management practiced inside the firm.

This book examines the source of technological innovation in the healthcare industry. Specifically, for the firms in each of the innovative sectors listed above we ask the following set of questions:

• What products do these companies make and what is so innovative about them?

• What are the different business models of innovation pursued by firms in this sector, and how do they finance them?

• What are the strategies pursued by firms in this sector?

• What are the key success factors for innovative firms in this sector?

• How have firms in these sectors, and the sectors themselves, grown over time?

• What impact have these firms had on the organization and delivery of healthcare? . What are the important competitive and regulatory forces shaping these sectors?

• What trends are taking place among downstream customers that these sectors will increasingly need to acknowledge and deal with?

Why Study the Producers of Healthcare Products?

One cannot fully understand the technological imperative in the US healthcare system or control its costs unless one understands the relationship that vendors of new products have with individual physicians. Hospitals may not fully appreciate that their physicians often develop closer alliances and attachments to the manufacturing firms than to their own organizations. These attachments have as much to do with the innovative features of the products made as with the intense sales and marketing support that goes with them. Indeed, vendors and physicians have developed a two-way exchange of mutual benefits that executives and purchasers may have trouble modifying.

This entire set of exchanges is poorly understood. They are now under scrutiny by the Federal and State Governments in the US as part of a larger inquiry into “conflicts of interest”. Research suggests that physicians play a wide variety of roles in the product innovation and entrepreneurship process, only some of which pose potential problems of conflict of interest.4

Provider Difficulties in Controlling the Diffusion of Technology

Based on the preceding section, purchasers and providers will likely face difficulties in controlling the diffusion of new technology. Moreover, provider organizations may face unforeseen difficulties in developing “integrated delivery networks” and “accountable care organizations” to partner with their physicians, and launching “value analysis committees” with their clinicians to control the selection, prices, and utilization of high-cost supplies. In both instances, the physicians’ loyalty lies elsewhere.

Lack of provider focus on upstream supply costs

To aggravate this problem, many provider organizations have concerned themselves primarily with the “downstream” portions of the value chain: government purchasers and fiscal intermediaries who reimburse them. They have largely ignored the “upstream” players in the value chain: producers/manufacturers and the distributors of their products. This lack of attention is important for several reasons. Healthcare supplies (e.g., drugs, medical devices, medical–surgical supplies, etc.) account for 19 percent of a hospital’s total expenditures, according to US government figures. If one includes the costs of handling and distributing these supplies internally, as well as the cost of all services contracted from the outside, the percentage of hospital expenditures may reach as high as 30 percent. These are portions of the hospital’s cost structure that historically have been undermanaged and now represent a major area for cost containment and improved supply utilization.

When hospital executives begin to look under the hood of their supply chain, the picture is not pretty. Not only are supply chain costs the second largest cost bucket, but they are also fragmented among lots of expense areas in the hospital – – each with its own manager who may not have been trained in managing supply expense. Hospitals have only recently began to focus for the first time on “supply chain management” and managing the cost and utilization of “physician preference items” (PPIs) – – the products for which their physicians have specific vendor and/or model preferences.

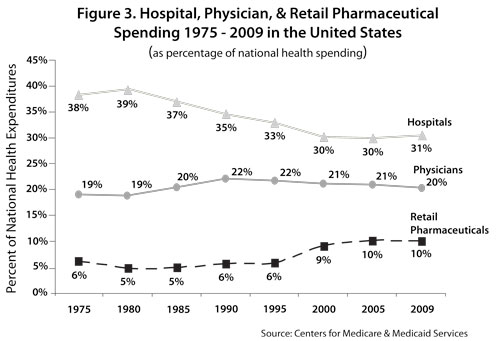

Within the large bucket of supply expense, the two biggest categories of spending are drugs and medical-surgical supplies, including medical devices. Costs for these supplies have been rising quite rapidly. Retail pharmaceutical costs as a percentage of national health expenditures have doubled in the US over the past three decades from 5 percent (1980) to 10.1 percent (2009). This represents an average annual growth of 11.9 percent, contrasted with hospital expenditure growth of 7.5 percent and physician expenditure growth of 9.2 percent.5 Trend data reveal that pharmaceutical costs alone are slowly approaching shares of total spending by hospital and physician services – areas that historically have accounted for the majority of health spending (see Figure 3).6 Indeed, comparable figures from Canada reveal that retail pharmaceutical spending has recently overtaken spending on physician services.

These cost figures do not include pharmaceutical products shipped to hospitals, which are embedded in hospital cost figures and which may account for 10–15 percent of total prescription drugs costs. Research on hospital finance suggests that prescription drugs amount to 3.5 – 7.9 percent of hospital costs.7 Medical devices costs have also been rising. Device spending in the US reached $55–65 billion at the turn of the millennium, and now amounts to roughly $90 billion – with $146 billion spent globally. Much of this rise is due to the technological imperative noted above. We estimate that medical devices accounts for roughly 5.0 – 6.2 percent of hospital costs.

This identification of drug and device costs buried in the hospital spending bucket is important. We might take the 3.5 – 7.9 percent and 5.0 – 6.2 percent of hospital spending on drugs and devices (respectively) and re-allocate them to retail pharmaceutical spending (thus yielding a more robust measure of product spending). We would then find that the three trends lines in Figure 3 converging more closely together. Stated differently, the US is beginning to spend as much on the products as it does on the providers who utilize them.

Why is drug spending converging on the amount we spend on hospitals and physicians? The answer lies in the multiple drivers behind all three trend lines. Here we will consider the drivers of increasing pharmaceutical spending. Drug spending as a percentage of total national health expenditures began to rise in the late 1980s and early 1990s in part due to the rise of managed care organizations (MCOs) and thus increasing drug plan coverage offered by both private and public sector payers and MCOs. Such coverage reduced out-of-pocket spending by consumers, likely reduced the price elasticity of drugs, and may have promoted moral hazard. Rising insurance drug coverage may have permitted the market to accommodate more costly but beneficial drugs which, in turn, were demanded and consumed by patients (and increased their drug spending) and which, in turn, stimulated further growth in insurance coverage.8

The Hatch-Waxman Act of 1984 provided new exclusivity incentives to pharmaceutical manufacturers to develop blockbuster drugs that addressed chronic conditions and lifestyle diseases common in the population and thereby increased the volume of drugs sold. Drug spending also rose during this period due to the rise of the biotechnology industry and its expensive set of biological products. In addition, the advent of pharmacy benefit management firms brought changes in “insurance technology” to reduce the cost of administering frequent, small outpatient drug claims. These changes reduced the cost and increased the convenience and availability of drug coverage, which also spurred increased coverage and spending.9

Drug spending further accelerated between 1995-2005 due to rising drug prices, the FDA Modernization Act which permitted direct-to-consumer (DTC) advertising in the US (made more effective by the growing insurance coverage), the Medicare Modernization Act which expanded prescription drug coverage among the elderly, the pharmaceutical industry’s massive expansion of its sales force, the shift to ambulatory care (and thus retail pharmaceutical spending), and the likely substitution of certain drugs (e.g., statins) for more expensive hospitalizations by reducing acute myocardial infarctions.

Convergence of Technologies Across Sectors

The foregoing section suggests that spending levels on technology are approaching spending levels on the providers of care who use these technologies. In addition, these technology sectors are increasingly converging with one another. Several new innovations in research, product development, and healthcare delivery rely on the joint use of technologies from multiple sectors.

A familiar example is the drug-eluting stent (DES), which combines a bare metal stent made by a device manufacturer coated with a pharmaceutical to reduce narrowing of the heart vessels due to postsurgical scarring (restinosis). Such products have reduced the incidence of restinosis from over 25 percent to single digits. Another convergent product has been developed in orthopedic surgery. Here, a graft-holding titanium cage (the device) is merged with a biological agent (bone morphogenic protein-2, or BMP-2) to develop a product to promote bone fusion following back surgery, thus obviating the need to take a bone graft out of a patient’s hip. Clinicians have found that biotechnology drugs may work on only specific subsets of patients that express certain proteins. Some manufacturers have developed in vitro tests to identify the appropriate genetic subgroup in which a drug is effective. Such diagnostic test – drug/device combinations constitute the advent of personalized medicine: use clinical biomarkers to match drug/device therapies to patient sub-populations.

The future of innovation in healthcare may thus involve leveraging a greater number of product combinations across manufacturing sectors. The development, utilization, and reimbursement of these combined technologies will require a greater understanding of the component products and the sectors that produce them. Payers and clinicians will find this opportunity for convergent development very attractive, since it leads to higher efficacy rates of treatment.

Nevertheless, there are some barriers to technological convergence, and many of them are found among the manufacturers themselves. Pharmaceutical firms have not yet embraced this convergent development with diagnostics (i.e., personalized medicine), since it may lead to higher patient exclusion rates for patients who fail the biomarker assessment, smaller market sizes for their products, higher development costs (larger patient pools and more sites for clinical trials), and higher marketing costs (educate physicians, change physician practice, more complex diagnosing).10 Another barrier is the difference in cultures and business models as one goes from one sector to another. Biotechnology and medical device firms focus on different elements of the value chain – – research in the former, development in the latter – – with very different product development cycles (i.e., long-term versus short-term). Convergent product development will require enormous skills in alliance formation and management.

Similarities and Differences Across Producer Sectors

Five themes highlight the commonalities in the innovation process across the above producer sectors: risk, capital, time, space, and scale. Most of the healthcare sectors are characterized by high risk. Failure rates in the life sciences are especially high, as are the failure rates of new ventures in all of the sectors studied here. Firms in these sectors require success with the technologies they develop and early success in order to survive. They also require heavy injections of capital from venture capitalists and the public (in the form of initial public offerings or IPOs, secondary offerings, etc.) in order to sustain themselves through the innovation process, especially as this process may take years. Capital and time often interact in the form of “boom and bust” cycles in some of these sectors (e.g., biotechnology), as a sector goes in and out of fashion with venture capitalists or as the window for IPOs periodically opens and closes.

Time is also important in studying these sectors for three other reasons. First, the products developed in these sectors have development cycles that can be either long in duration (e.g., pharmaceuticals and biologicals) or short in duration (e.g., medical devices). Second, the sector itself may be either youthful (e.g., biotechnology) or older (e.g., pharmaceuticals). These time dimensions dictate much of the strategic behaviour of firms within these sectors, and also their capabilities to innovate. Third, there is a tendency for analysts and observers (as well as investors) to overestimate the impact of new technology on these sectors in the short-term, and to underestimate the impact of new technology in the long-term.

A fourth important theme is space. Some of the sectors are truly global businesses, such as pharmaceuticals. Other sectors, such as biotechnology, are found in many nations with a common aim to become global businesses. Still other sectors, such as medical devices and information technology, are largely domestic (medical devices are heavily based in the US), although they too are trying to penetrate foreign markets.

Lastly, firm scale and scope are important dimensions. All of the sectors are growing; they thus all face issues of managing large size and diversity of operations, and thus the need to coordinate their complex operations. They also all pursue M&A strategies, while some simultaneously pursue strategies of vertical integration and diversification.

About the author

Lawton Robert Burns is the Chair of the Health Care Management Department, the James Joo-Jin Kim Professor, a Professor of Health Care Management, and a Professor of Management in the Wharton School at the University of Pennsylvania. He is also Director of the Wharton Center for Health Management & Economics. He is the author of The Business of Healthcare Innovation (Cambridge University Press 2012).

References

1. Lawton R. Burns, The Health Care Value Chain: Producers, Purchasers, and Providers (San Francisco: Jossey-Bass, 2002).

2. Sheila Smith, Joseph Newhouse, and Mark Freeland. ”Income, Insurance, and Technology: Why Does Health Spending Outpace Economic Growth?” Health Affairs 28 (2009): 1276-1284. Sheila Smith, Stephen Heffler, and Mark Freeland. “The Next Decade of Health Spending: A New Outlook,” Health Affairs 18(1999): 86-95. Joseph Newhouse “Medical Care Costs: How Much Welfare Loss?” Journal of Economic Perspectives 6(3) (1992): 3-21. David Cutler. “The Cost and Financing of Health Care,” American Economic Review, 85(2), May 1995: 32-37.

3. “The Health of Nations: A Survey of Health-Care Finance,” Economist (July 17, 2004): 3–19. David Cutler and Mark McClelland, “Is Technological Change in Medicine Worth It?” Health Affairs 20(5) (2001): 11–29. David Cutler, Allison Rosen, and Sandeep Vijan, “The Value of Medical Spending in the United States, 1960-2000,” New England Journal of Medicine 355 (2006): 920-927. Value Group, The Value of Investment in Health Care: Better Care, Better Lives. Available at: http://www.aha.org/aha/value/index.html. Accessed on August 24, 2004.

4. Stefanos Zenios, Lawton R. Burns, and Lyn Denend. The Role of Physicians in Device Innovation: Critical Success Factor or Conflict of Interest? Case OIT-105 (Palo Alto, CA: Stanford University Graduate School of Business, 2011.

5. Center for Medicare and Medicaid Services (CMS). Office of the Actuary.A. Caitlin et al., “National Health Spending in 2005: The Slowdown Continues,” Health Affairs 26(1) (2007): 142-153.

6. This trend was noted in the 1990s by Patricia Danzon and Mark Pauly, “Insurance and New Technology: From Hospital to Drugstore,” Health Affairs 20(5) (2001: 86-100.

7. Nancy Kane and Richard Siegrist, Understanding Rising Hospital Inpatient Costs: Key Components of Cost and the Impact on Poor Quality (Unpublished Report, August 12, 2002). Available at: www.heartland.org/custom/semod_policybot/pdf/14629.pdf. Accessed on March 3, 2011.

8. Danzon and Pauly. Burton Weisbrod, “The Health Care Quadrilemma:An Essay on Technological Change, Insurance, Quality of Care, and Cost Containment,” Journal of Economic Literature 29 (1991): 523-552.

9. Danzon and Pauly.

10. Ibid